The Future of Federal Financial Management

Envision the Future

Every day, millions of American have financial interactions with the federal government

Since its founding, Treasury has developed the processes for managing public funds as the federal government grew in scope and scale. The Future of Federal Financial Management describes a 10-year vision that continues Treasury's tradition of forward-looking financial management.

Download the VisionA New Role for Federal Chief Financial Officers

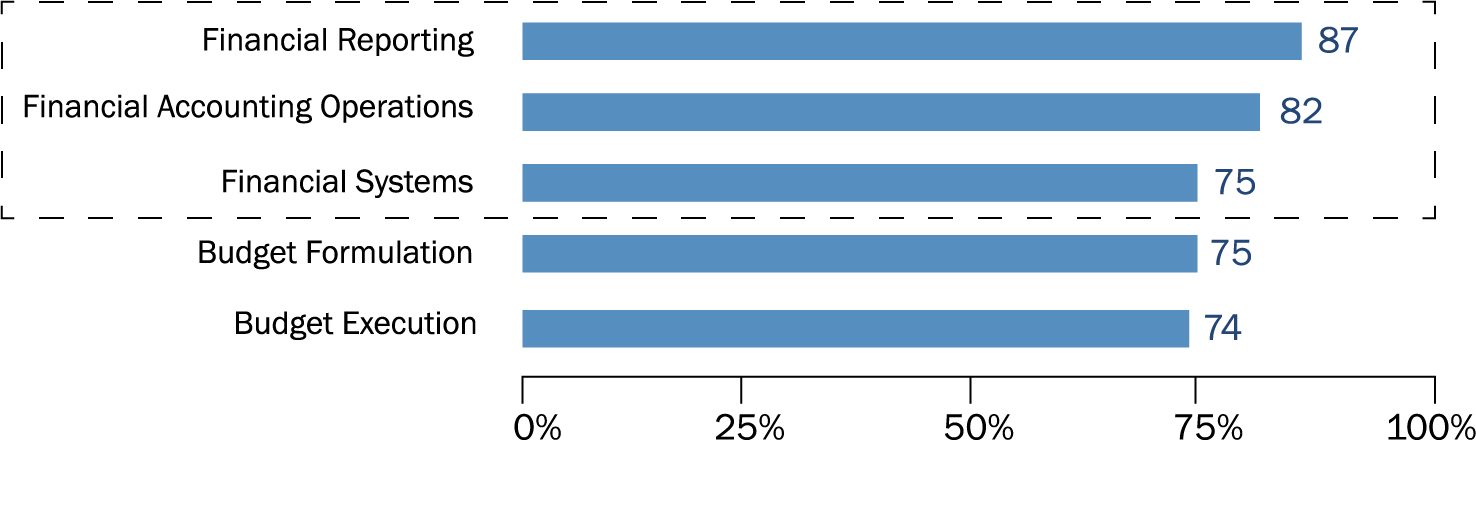

Over three-quarters of Federal CFOs have direct responsibility for financial reporting, accounting operations and financial systems. In a recent survey, they described their staffs as predominantly concerned with transaction processing.

Source, "Annual CFO Survey: Navigating Disruption", Association of Government Accountants, January 2018

In the future, we must enable the Federal CFOs to refocus their attention from financial transaction processing to program performance measuring and reporting.

How We'll Get There

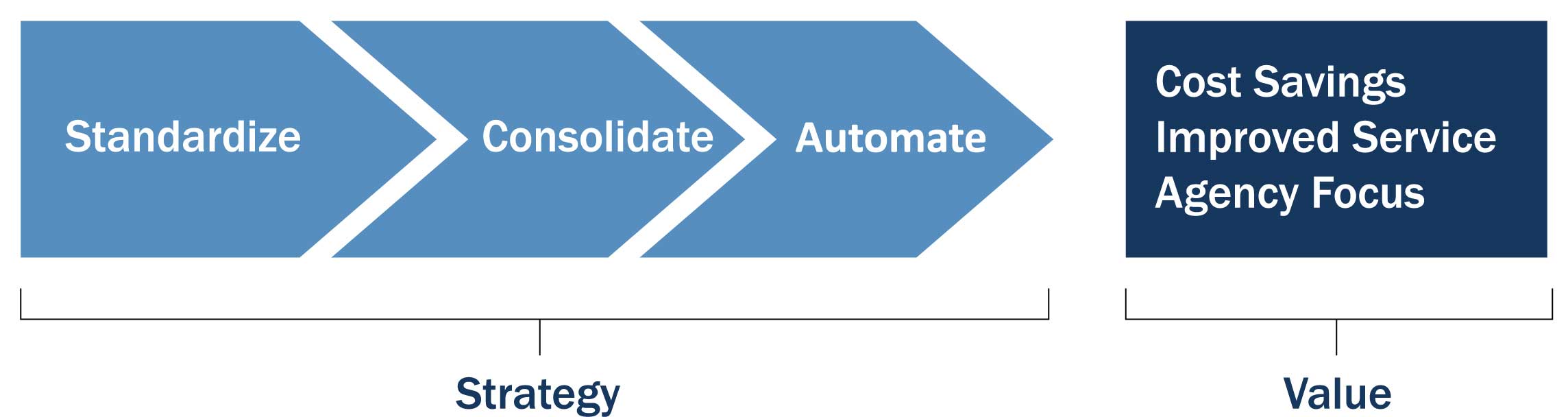

Treasury has a plan to maximize the efficiency of the common processes of disbursing, collections, reporting and administrative operations, so that agency CFOs can refocus their attention from transaction processing to program performance management.

Treasury's Plan for Financial Transaction Processing

This time-tested strategy of standardization, consolidation, and automation will create genuine value for government agencies and taxpayers. It produces savings by reducing the number of redundant information systems. By consolidating investment, it enables innovations that have improved customer service. And most important, it relieves the agencies of burdensome administrative operations so they can focus on their mission.

Last modified 07/24/19