Transformation Stories

Lead. Transform. Deliver.

The CARES Act and the Fiscal Service

The Coronavirus Aid, Relief, and Economic Security Act, or the CARES Act, was the government's largest intervention in the US economy since the Great Depression. The two trillion-dollar plus program provided financial relief to individuals, small businesses, the aviation industry, state & local government - even the financial markets themselves - to respond to the fast-moving COVID-19 pandemic.

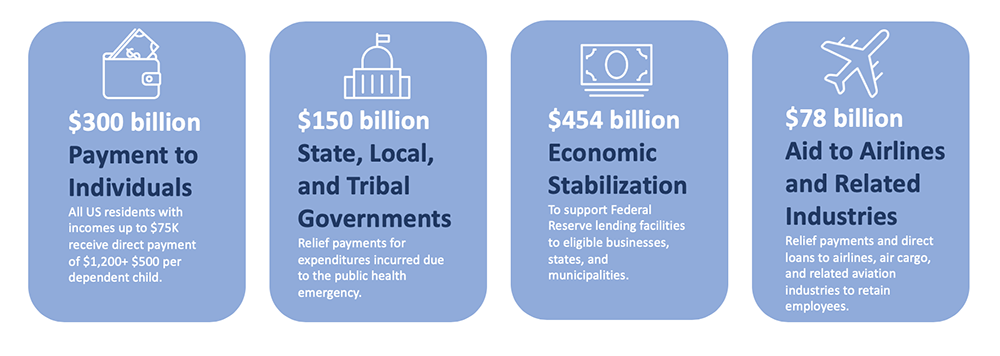

The CARES Act established six major relief programs. The Fiscal Service was critical to the implementation of four of those programs.

Fiscal's Role in the CARES Act

The Fiscal Service helped implement CARES Act programs that provided relief for individuals, state, local, and tribal governments, the airline industry, and financial markets.

Why the Fiscal Service? To roll-out these programs quickly, the government had to rely on existing capability. The Fiscal Service has that existing capability and know-how. But equally important - Fiscal had the agility to expand its existing processes, or repurpose similar processes, to meet the urgent demand of the CARES Act.

Providing Payments to Individuals

By April, more than 23 million Americans filed for unemployment benefits. To put cash in the hands of Americans as quickly as possible, the CARES Act provided $300 billion to eligible recipients - $1200 per each eligible recipient, plus $500 for each dependent child. Working with the IRS, the Fiscal Service's Kansas City and Philadelphia Financial Centers issued checks and made direct deposits into recipients' accounts and Direct Express Cards. Approximately 75% of the payments were sent electronically. Within three weeks of the passage of the CARES Act, 81 million Americans had received an Economic Impact Payment. Starting in May, through its existing US Debit Card program, the Fiscal Service issued payments in the form debit cards to four million recipients. By June 3, $267 billion was disbursed to 159 million Americans.

Relief for State, Local, and Tribal Governments

While the demand for health and safety services skyrocketed, state and local revenues plummeted. On average, state tax revenues have fallen 10 to 20 percent since February. The Fiscal Service's ARC used its existing vendor payment processes to meet the new, urgent demand for cash. ARC and the Kansas City Financial Center used existing processes to process and deliver relief to 600 tribal governments. Most payments were delivered by mid-May, and by June, 834 payments valued at $146.6 billion provided relief.

Retaining Airline Industry Workforce

By April, air travel had fallen 95% from the previous year. The CARES Act provided $78 billion to help airlines retain its skilled workforce. To screen applications quickly, the Fiscal Service's Debt Management Service in Austin, Texas vetted over 700 applications within days of their receipt at Treasury. The Fiscal Service's ARC used its existing vendor payment process to deliver processes quickly. By June, 718 applicants received $17.8 billion in relief funds.

Financial Economic Stability

During an economic downturn, commercial banks often slow down their lending to businesses. The Federal Reserve can serve as the "lender of last resort" through special-purpose "loan or credit facilities." The CARES Act authorized four such facilities - for small business, to backstop SBA loans, and even to lend to local governments. The CARES Act provided $454 billion in potential loans that could ultimately generate $2 Trillion in lending. The Federal Reserve is performing this function as the Fiscal Agent of the US Treasury. The movement of funds from the Treasury General Account to establish the four credit facilities can only be executed by the Fiscal Assistant Secretary.

While one side of the Fiscal Service was quickly standing up the various CARES programs - the other side had to find a way to pay for it. Cash Management Bills are short-term securities that Treasury issues for emergency financing needs. Usually, Treasury holds only a few auctions to sell CMBs each year – as of May, there were more than 50 CMB auctions.

Transparency

The Fiscal Service will also provide an important role in educating the public about how the $2.58 trillion of the CARES Act was spent. The Fiscal Service's USAspending and Your Guide to America's Finances website provides free, easy to use tools that can allow anyone to learn more about federal spending. Currently, USASpending provides a COVID-19 related contract visualization tool, that allows users to see track the General Service Administration’s obligation dashboard that shows information on contract awards response to COVID. This month, in response to the Office of Management and Budget's Memorandum M-20-21, federal agencies will begin supplementing existing reporting of spending related to the CARES Act.

A National, Dedicated Workforce

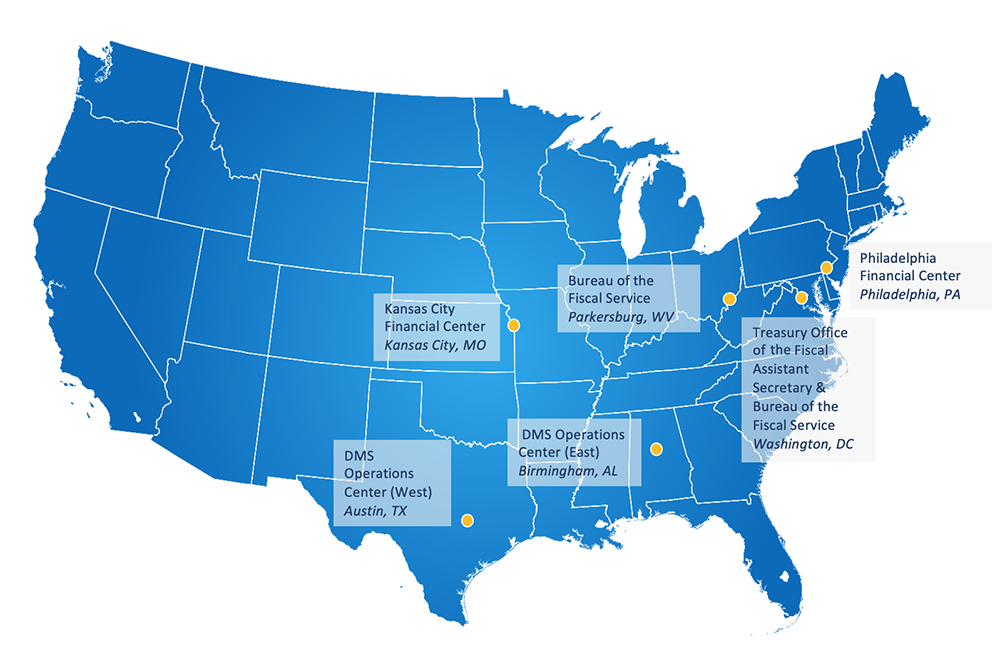

The bureau’s support of the CARES Act didn't occur only from our offices in Washington, DC. In fact, much of the work didn't occur in offices at all. The Fiscal Service workforce did its part by staying home to avoid the spread of the coronavirus.

Fiscal Service Operations Supporting the CARES Act

Fiscal employees throughout the nation served. While some employees had to be on-site – many others worked from their kitchens, and basements, and extra bedrooms in areas that included Kansas City, Austin, Birmingham, Philadelphia, Washington, and Parkersburg, WV.

The Fiscal Service's motto is to lead, transform, and deliver. In the months following the rapid spread of the coronavirus and enactment of the CARES Act, the Fiscal Service lived up to its motto. The Fiscal Service led in support of the CARES Act. It transformed itself into a virtual organization overnight without losing its collaborative culture. And it delivered for the American people.

For More

Download The CARES Act and the Fiscal Service PowerPoint presentation and save it. The presentation provides a deck and an audio narrative and script.

Last modified 01/27/25